The law specifies how West Virginia Junior College must determine the amount of Title IV program assistance funds that a student earns if he or she withdraws from school. A student is considered withdrawn if the student ceases attendance and is not scheduled to begin another course within the payment period. If the student is enrolled in programs taught in modules, the student is considered withdrawn if the student ceases attendance and is not scheduled to begin another course within the payment period for more than 45 calendar days after the end of the module the student ceased attending.

A student is not considered to have withdrawn (in the case a student is enrolled in a program taught in modules) if the institution obtains written confirmation from the student at the time of withdrawal that he or she will attend a later module in the same payment period.

Additionally, there are exceptions to when a student is considered withdrawn. For all programs, a student who completes all the requirements for graduation from his or her program before completing the days or hours in the period that he or she was schedule to complete is not considered to have withdrawn. For programs offered in modules, a student is not considered to have withdrawn if the student successfully completes one module that includes 49 percent or more of the number of days in the payment period, excluding schedule breaks of five or more consecutive days and all days between modules. Successful completion means earning at least one passing grade. For programs offered in modules, a student is not considered to have withdrawn if the student successfully completes coursework equal to or greater than the coursework required for the institution’s definition of half-time status (6 credit hours) for the payment period. Successful completion means earning at least one passing grade.

If a student does not meet one of the exceptions above, a calculation is performed to determine the amount of federal student aid a student has earned up to his or her point of withdrawal.

The Title IV Federal student aid programs covered by this Return to Title IV policy are Federal Pell Grants, Iraq and Afghanistan Service Grants, Direct Loans (Subsidized and Unsubsidized), Direct PLUS Loans, and Federal Supplemental Educational Opportunity Grants (FSEOG).

Though the student’s aid is posted to the student’s account at the start of each payment period, the student earns the funds as he or she completes the payment period. If the student withdraws during the payment period, the amount of Title IV program assistance that was earned up to that point is determined by a specific formula. If the student received (or the institution or parent received on your behalf) less assistance than the amount earned, the student may be able to receive those additional funds. If the student received more assistance than the amount earned, the excess funds must be returned by the institution and or the student.

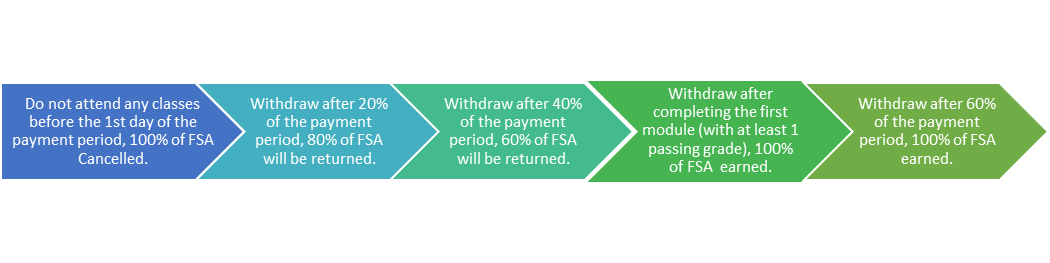

The amount of assistance that is earned is determined on a pro rata basis. For example, if a student completed 30% of the payment period, the student earned 30% of the assistance that was originally scheduled for the student to receive. Once the student has completed more than 60% of the payment period, the student earned all the assistance that was scheduled for the student to receive for that period. If the student did not receive all the funds that were earned, the student may be due a post-withdrawal disbursement. If the post-withdrawal disbursement includes loan funds, the institution will obtain the student’s (or parent’s in the case of a PLUS Loan) permission before it can disburse them. The student (or parent) may choose to decline some or all the loan funds so that additional debt is not incurred. West Virginia Junior College may automatically use all or a portion of your post-withdrawal disbursement of grant funds for tuition and fees. Any excess grant funds will be disbursed to the student. West Virginia Junior College needs a student’s permission to use the post-withdrawal grant disbursement for all other institutional charges. If the student does not give permission, the funds cannot be used for institutional charges. However, it may be in the student’s best interest to allow the school to keep the funds to reduce the debt at the school. If a student is eligible for a post-withdrawal disbursement for Title IV funds, it will be processed for the student and a refund will be issued within 14 days of the credit balance.

If the student (or parent) received excess Title IV program funds that must be returned, the institution will return a portion of the excess equal to the lesser of:

- the institutional charges multiplied by the unearned percentage of the student’s Title IV funds, or

- the entire amount of excess funds.

West Virginia Junior College must return this amount even if it didn’t keep this amount of the Title IV program funds.

If West Virginia Junior College is not required to return all of the excess funds, the student must return the remaining amount. For any loan funds that the student must return, the student (or the parent for a Direct PLUS Loan) must repay the loan in accordance with the terms and conditions of the promissory note. That is, a student will make scheduled payments to the holder of the loan over a period of time.

Any amount of unearned grant funds that the student must return is called an overpayment. The maximum amount of a grant overpayment that the student must repay is half of the grant funds received or were scheduled to receive. A student does not have to repay a grant overpayment if the original amount of the overpayment is $50 or less. The student must make arrangements with West Virginia Junior College or the Department of Education to return the unearned grant funds.

Funds that are returned to the federal government are used to reduce the outstanding balances in individual federal programs. Unearned financial aid returned by the West Virginia Junior College must be allocated in the following order:

- Federal Unsubsidized Direct Loan

- Federal Subsidized Direct Loan

- Federal Direct Parent Loan (PLUS)

- Federal Pell Grant

- Iraq and Afghanistan Service Grants

- Federal Supplemental Educational Opportunity Grant (SEOG)

If the institution is required to return Title IV funds as a result of the Return to Title IV calculation, this return will occur within 45 days of the date the institution determined you have withdrawn.

The requirements for Title IV program funds when a student withdraws are separate from the refund policy that the institution has. Therefore, the student may still owe funds to West Virginia Junior College to cover unpaid institutional charges. The institution may also charge the student for any Title IV program funds that the institution was required to return. Students should review the institution’s cancellation and refund policy which is described in the West Virginia Junior College catalog.

To officially withdraw, a student should contact the College President (verbally or in writing).

An Unofficial Withdrawal Occurs when:

- A student leaves the school without notice, Or

- When all courses in which the student is enrolled are given a W or WF grade due to non- completion of the course.

The student’s last date of attendance or participation in any academic activity will be the date used to calculate the Return of Title IV Funds. This last date of attendance is determined by using the institution’s attendance records.

Return to Title IV Illustration

Example 1

Attended 24 days of the payment period which is 84 days in length.

24/84 = 29% FSA Earned

71% of FSA Will Be Returned

Example 2

Attended 52 days of the payment period which is 84 days in length.

52/84 = 62% FSA Earned

100% of FSA Earned with 0% Returned